It’s finally here! Thanks to everyone who took the survey about relationships and money way back in (gulp!) August. It was fascinating to put these results together and discover how different — and alike! — we are when it comes to fellow couples and their finances. I gotta admit, there were as many things that surprised me as didn’t surprise me! Without further ado, you can click through below to browse the results.

Be sure to check out the end of the post, where I’ve written a brief wrap-up with my own thoughts/experiences about the data (and love + finances), and also shared some resources with you.

I hope you enjoyed reading through all that (and hopefully also understand why it took me a little while to put together!). Here are a couple notes I wanted to share with you about the survey:

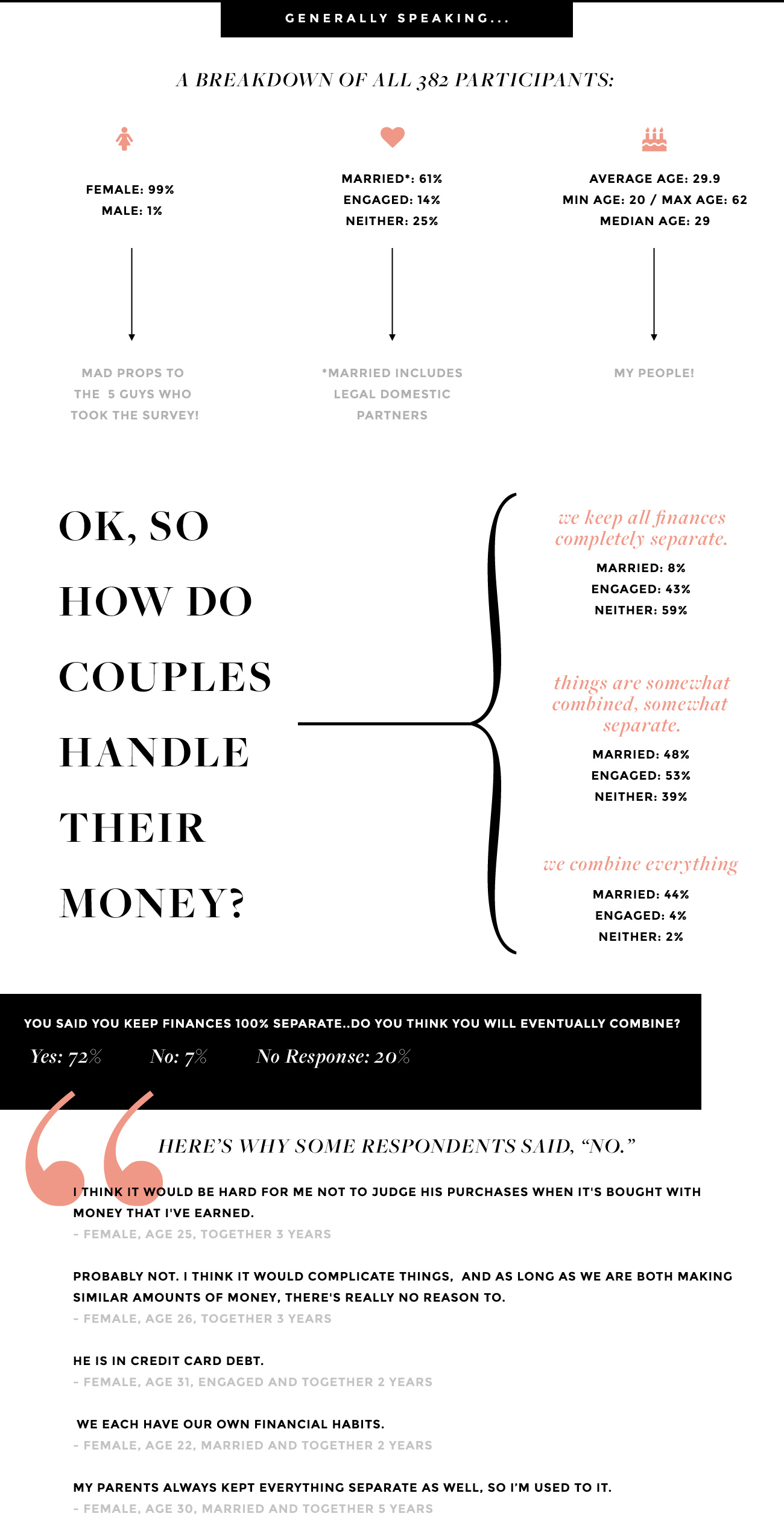

+ While there were well over 450 surveys started, I ended up having to throw many out, as some individuals started the survey but didn’t answer the biggest question: how they shared or split finances with their significant other. So long as the participant answered that question, I kept their data as part of the survey, though some people didn’t complete the whole thing. This is why I’ve included “No Response” percentages with some of the data. The total number of participants included in the survey is 382. Not bad!

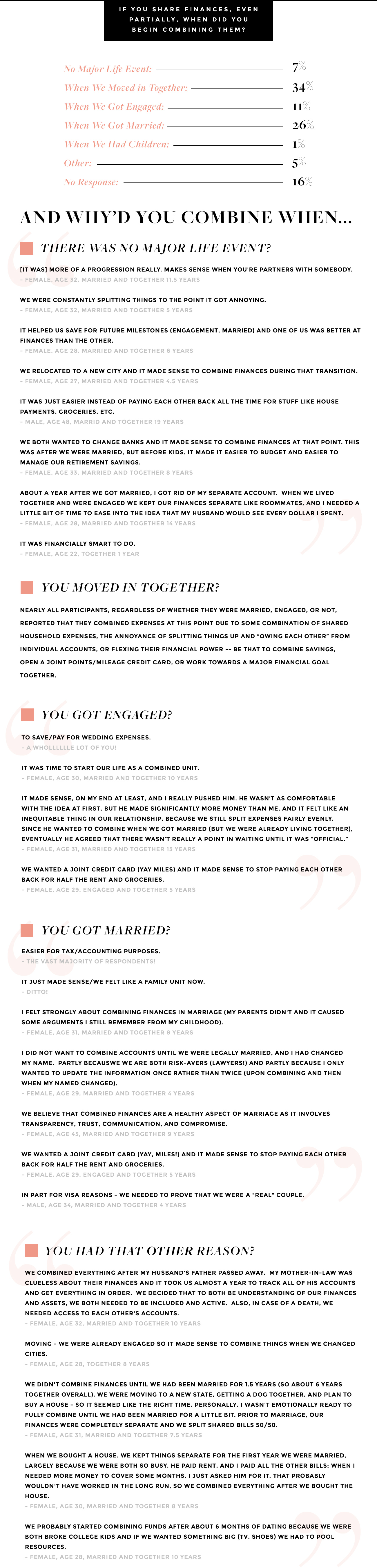

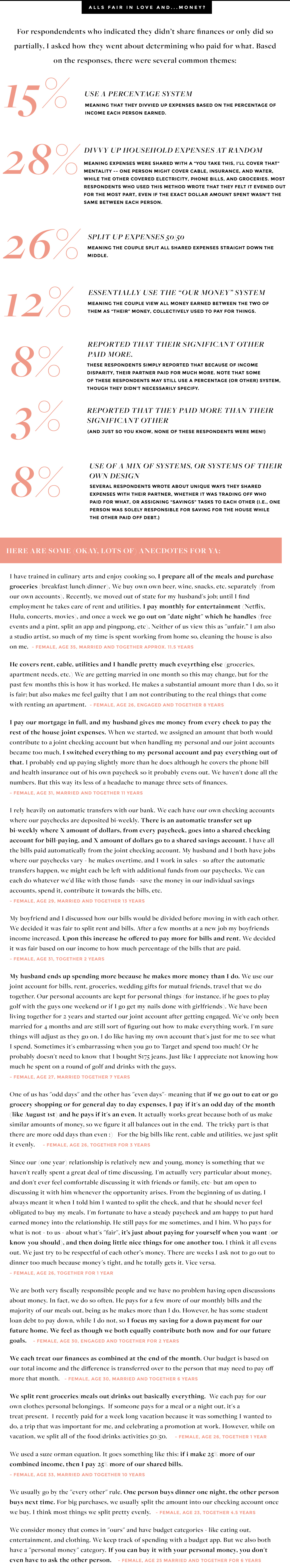

+ This thing is definitely not scientific. I probably made the mistake of leaving too many questions as qualitative (i.e., people could write answers in), so I had to do some manual tabulation for things like how people were approaching money (the whole percentages, 50/50 thing, etc). In these cases though, I tried to interpret each answer individually based on the patterns I was seeing, and most of the time, responses were pretty clear cut (i.e., the person would write “we break it down by a percentage of income” or “we split everything half and half).

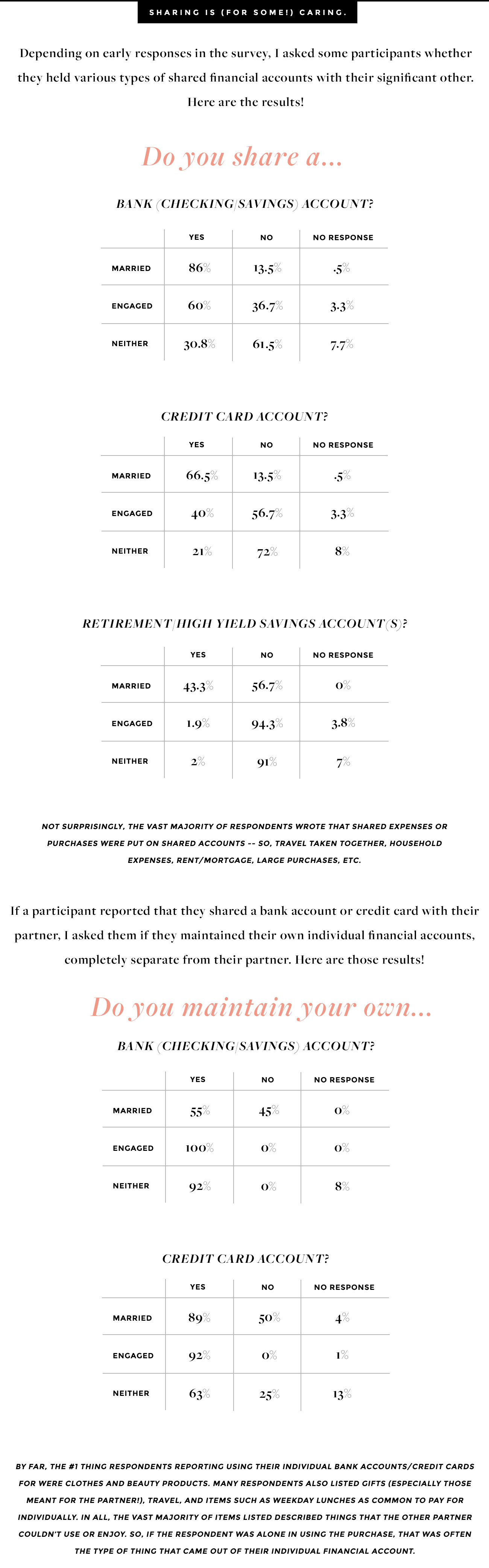

+ So, what are my takeaways, having spent A LOT of time reading everyone’s stories? I would say that by and large, it’s common for couples to share the burden of basic household expenses, and that many couples also take advantage of individual bank accounts/credit cards to pay for items they don’t jointly enjoy — whether that’s clothing, nights out with friends, travel, etc. Is this a hard and fast rule? Absolutely not — there were also many couples who viewed all money made as one collective pot, and still others who kept things totally separate (even after marriage). So scratch that — my biggest takeaway is that there’s no one way or right answer, and the most important thing is to keep communication about money open and honest.

+ One of the biggest surprises for me was that over 26% of respondents said they never argue about money! Does this surprise you, too? The source of my surprise probably isn’t shocking — even after such a long time together, Joe and I are not immune to “discussions” about money. I found it interesting to read about everyone’s perspectives about money from early relationship stages, well on into marriage. I think it’s something that can evolve over time, and as it’s evolved in my own relationship, there can certainly be growing pains. When we started dating, Joe and I were college freshmen…obviously, we have a whole different set of expectations around money from that time, through our 20s, and into our 30s as a married couple!

+ I’m so grateful that so many of you felt compelled to share your stories, histories, worries, anxieties, methodologies, and genius ideas around money. There were far, far more short-answer responses than I could have possibly have included here, so I tried to create a sampling within specific categories to showcase the diversity, as well as interesting insights. With that being said, if you’d like to contribute more to a specific question (even if you didn’t take the survey!) I encourage you to do so in the comments below. While comments require an email address, this won’t be published, so you can be anonymous if you’d like. It goes without saying, but please keep all comments respectful and open-minded — every person and couple is different! Here are some of the questions I asked survey participants:

- Do you and your significant other combine all finances, keep everything separate, or are things partially combined/partially separate?

- If you combine finances, even only partially, when did you choose to do so, and why?

- Do you share bank accounts, credit cards, and/or retirement accounts with your significant other?

- If you combine your finances, do you also still keep your own individual bank accounts/credit cards?

- What types of things do you purchase out of shared and individual accounts?

- How do you determine who pays for what within your relationship? Does one person end up paying more? How do you ensure it’s equitable (or do you)?

- Do you have a household budget? If so, do you use any special software for it?

- How did you discuss sharing finances? Was it an easy conversation, or difficult?

- What’s the #1 thing financial related thing you argue about?

- Do you have any advice, resources, or rules to share when it comes to love + money?

BUDGET RESOURCES

Splitwise · iBank · Home Budget · You Need a Budget · Mint · Google Sheets · Quicken Square · VenMo · LearnVest · Personal Capitol

(Excel and Paper/Pen/Calculator round out the 12th and 13th items people used to create budgets!)

ADDITIONAL RESOURCES

Suze Orman · Dave Ramsey

Great post! I would love to see another survey on marriage and relationship advice. (i.e. how they met, how to keep things exciting, do they travel together and separately) As someone in a relationship hoping to get married over the next couple of years. It’s always good to hearing from young married couples.

This was very interesting to read! Would love to see more surveys done in the future. Happy New Year!

Love this! I always enjoy when bloggers interact with their readers, and I love hearing what other readers have to say. I definitely agree with Jewel above that it would be fun to read another post like this about relationship advice!

So interesting and surprising (to me), to see how many couples maintain separate bank accounts. I guess I’ve never been exposed to the finances of a married couple aside from my parents, so I definitely assumed everyone was like them (shared bank accounts). I don’t think the thought of separate accounts would ever cross their minds! Then again, they’re in their 60s, so I’m curious (and going to ask) if they ever did have separate accounts when they were younger. The thought never even occurred to me!

This is so amazing and insightful! When you posted the survey, I had just started seeing someone (like, had been on one date), so I didn’t respond as I wasn’t sure where that was even going. Now, we’ve been seeing each other for nearly five months, and as he’s older than I am I feel we’ll hit the more “serious” milestones a little quicker than I’d expect. Recently, I mentioned something about credit card debt, and he was very curious about mine. It’s quite high, and it’s embarrassing to me as it’s largely from impulsive purchases in my early 20’s, so I didn’t want to discuss it in depth or tell him the exact number, but it was a peek into a potential future conversation. I’m bookmarking this post in case I want to come back to it!

I loved reading all the responses. So interesting to me. Just a comment on the wise words one about never being a stay at home mom and having to ask your husband for an allowance. I have to guess that the person writing that does not have children. I too never thought I would ever want to stay home after I had a baby. I was almost 35 when I had my first, so I had worked for many years and had a nice career. But let me tell you, nothing prepared me for how I would feel when I had that baby. I did go back for about 6 months but I realized that my heart was not in it anymore and I wanted to be the one raising my own child. This was about 10 years ago and I have never looked back. My husband and I never had the kind of relationship where he “gave” me an allowance or I had to ask for money for anything. We are fortunate that he has a successful career and all of our money had been combined since we got married. We have all joint accounts and no one has to ask anyone for money. We know what is reasonable to spend, we have made good investment choices and we have no debt besides our mortgage. We made the decision, as a couple, that we thought the best thing was for me to stay home and raise our family. So I would hope that no one has a husband who would treat them like a child that they have to dole money out to if you were home raising their children. So ladies, you can still be independent and stay home with your children if you marry the kind of guy who will be supportive of you and your decisions. Personally, that’s the kind of guy I would shoot for anyway, regardless of whether you decide to stay home or not. The kind of guy who will be supportive of your choices no matter what is worth his weight in gold!